VAT error message: authentication failure

This article explains the steps to take if you've received an error message telling you there is something not quite right when trying to connect or reconnect FreeAgent to HMRC for Making Tax Digital (MTD) for VAT.

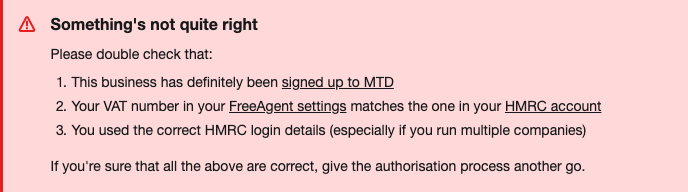

If HMRC does not recognise the Government Gateway credentials that you have entered, you’ll receive the error message below when trying to connect or reconnect FreeAgent to HMRC, or file your VAT return.

There can be a few other reasons for this error message. If you have full (level 8) access to your FreeAgent account, you can follow the steps below to identify and resolve the error.

1. Check that the VAT registration number is correct

Select 'Settings' from the drop-down menu in the top-right corner and then select 'VAT Registration'.

Make sure that the ‘VAT Registration Number’ is correct and matches the VAT registration number on your VAT certificate. You can search for your business’s VAT number here.

If the VAT registration number is incorrect, update it with the correct number and select ‘Save Changes’. Find out more about how to enter your business's VAT settings.

2. Check whether you’ve previously connected FreeAgent to HMRC or filed VAT returns using the same Government Gateway credentials

If your accountant has previously set up the MTD for VAT connection or filed VAT returns on your behalf using the credentials that you’re entering into FreeAgent, you may need to register for a new Government Gateway ID (HMRC online account) to set up the connection and file VAT returns yourself.

3. Check that you can log in to your HMRC online account using the Government Gateway credentials

Navigate to HMRC’s website to check if you can log in to your HMRC online account using the same Government Gateway credentials that you’re entering into FreeAgent. If you’re unable to log in, please see the following HMRC guidance.

4. Check that VAT has been enabled as a service

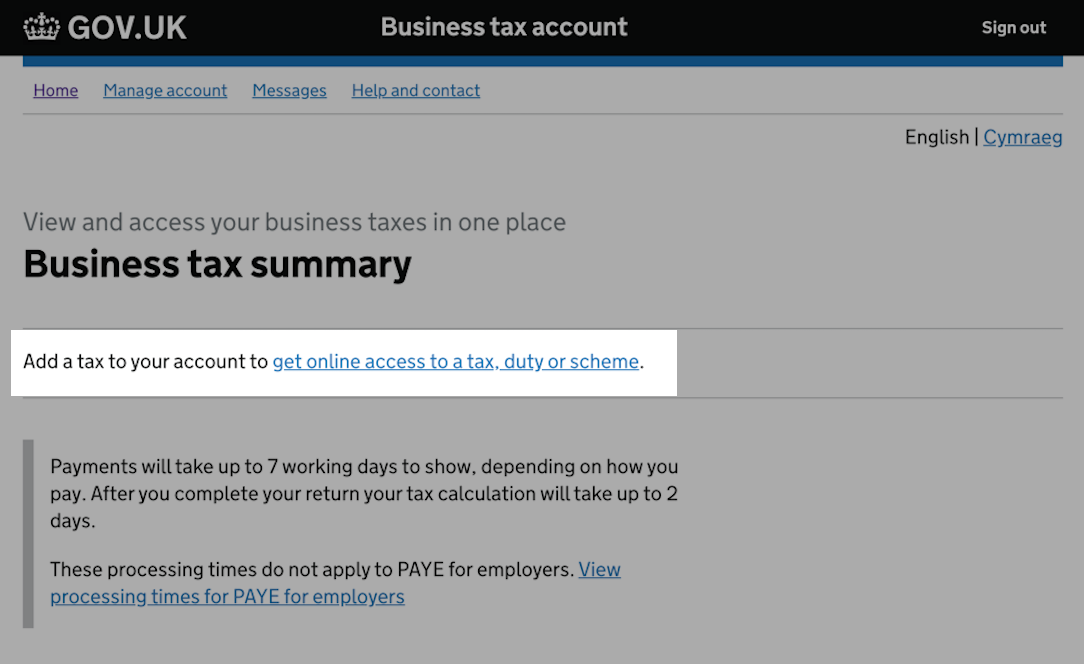

If you can log in to your HMRC online account, make sure that VAT has been enabled as a service. If it has, it should look similar to the image below.

If VAT hasn’t been enabled as a service, you’ll need to select ‘get online access to a tax, duty or scheme’ and follow the steps provided to add it. Please note that if you do need to do this, HMRC will send an activation code out in the post which can take up to 10 days to arrive. Once you’ve successfully enabled online filing, you’ll see a notification advising of return deadlines.

If you haven’t filed a VAT return yourself before, for example if your accountant was doing this for you previously, you may need to log in to your HMRC online account and authorise VAT as a service.

Please note that if your accountant has signed the business up for MTD, you will still need to select ‘Add Making Tax Digital for VAT to my account’.

5. Check that you’re entering your Government Gateway credentials manually

When connecting or reconnecting FreeAgent to HMRC, or submitting your VAT return through FreeAgent, make sure that your Government Gateway credentials are being entered manually and not being auto-filled by your browser.

If any of your details are being auto-filled, you should delete the auto-filled information and enter your Government Gateway ID and password manually instead, just as you would enter it to access your HMRC online account.

In the majority of cases, the authentication failure error message is caused by VAT not being enabled as a service on the HMRC online account, the credentials in FreeAgent being auto-filled or not being the same credentials used to access the HMRC online account.

If you continue to receive the error message after completing the troubleshooting steps above, please check with HMRC directly. As the error message has been sent from their system, they will need to investigate.